As the crypto universe continues its relentless expansion, Australia is rapidly emerging as a new frontier for crypto mining investments. With 2025 on the horizon, industry experts foresee a monumental surge in mining activities across the continent, catalyzed by a perfect storm of regulatory clarity, abundant renewable energy, and a rising appetite for digital assets like Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG). The mining landscape is shifting, and Australian entrepreneurs and international investors alike are gearing up to capitalize on the next big leap in blockchain technology and mining infrastructure.

The backbone of any crypto ecosystem lies in the mining rigs and hosting services that underpin the decentralized verification of transactions. Mining machines, tailored to crunch complex algorithms at blistering speeds, have become the key to unlocking the lucrative rewards of proof-of-work cryptocurrencies. Australian mining farms, sprawling with racks of cutting-edge mining rigs, promise not only stable returns but also pioneering advances in energy efficiency and scalability. As energy costs dominate operational budgets, local miners leverage Australia’s vast solar and wind resources, transforming the continent into an eco-friendly mining haven.

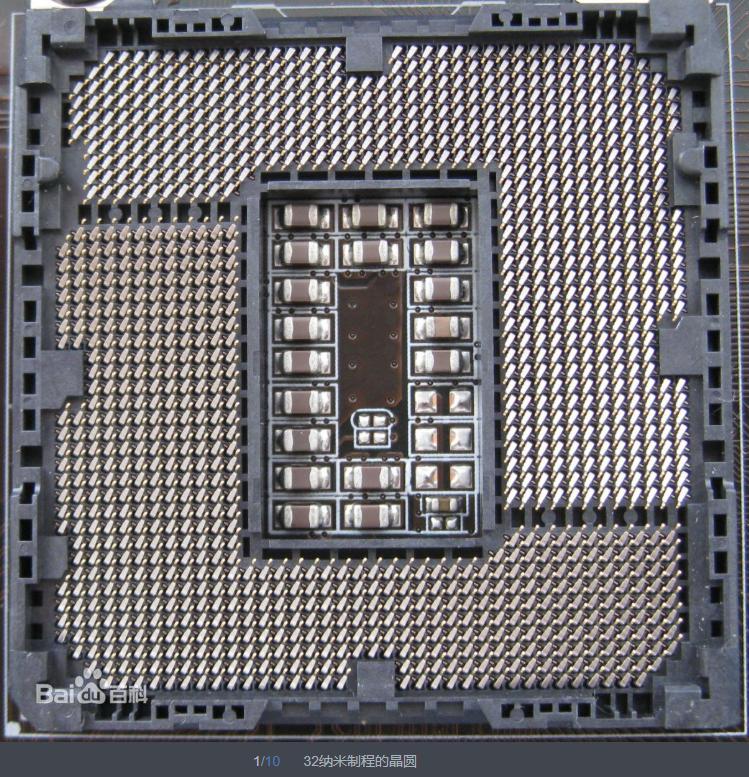

The increased deployment of application-specific integrated circuits (ASICs) and graphics processing units (GPUs) tailored specifically for mining various cryptocurrencies has revolutionized operational capacity. Bitcoin miners, in particular, dominate the scene with specialized ASIC miners designed to maximize hash rates while minimizing power consumption. Meanwhile, Ethereum mining rigs, often GPU-based, continue adapting to changes amid the network’s evolution towards proof-of-stake. This dynamic fosters diversification, as miners increasingly toggle between BTC and ETH, balancing profitability with network conditions and market volatility.

However, hardware alone doesn’t paint the full picture. Hosting services encapsulate the logistical complexities of running a mining operation—from cooling infrastructure to maintenance and security. Mining machine hosting providers in Australia are innovating rapidly, offering turnkey solutions that relieve individual miners from the burdens of technical upkeep and environmental management. These services facilitate seamless scaling, enabling investors to deploy large quantities of miners without geographic or technical constraints. The strategic pairing of hosting facilities with renewable energy further amplifies long-term sustainability, mitigating one of crypto mining’s most scrutinized aspects: its environmental footprint.

Australia’s openness to blockchain technology has also nurtured a fertile ground for crypto exchanges to flourish. These platforms serve as critical junctions, allowing miners to liquidate assets and traders to speculate on price movements of different tokens such as BTC, DOG, and ETH. The symbiotic relationship between exchanges and mining operators is driving a virtuous ecosystem of liquidity, innovation, and market resilience. Exchanges are also incorporating sophisticated tools like automated trading bots and lending protocols, creating layered opportunities for miners to hedge risks and maximize returns. This evolving ecosystem incentivizes mining farms to maintain robust, uninterrupted operations, thus ensuring steady contributions to blockchain security.

Interestingly, Dogecoin, initially a meme coin, has attained newfound legitimacy through its adoption in transactional use cases and celebrity endorsements. While not as hash-intensive as Bitcoin, DOG mining entails unique community-driven engagement, inspiring a burgeoning suite of mining rigs optimized for its distinctive algorithms. As the crypto market matures, niche tokens like Dogecoin foster greater inclusivity, inviting a broader demographic into mining ventures, and expanding the horizons beyond the traditional BTC and ETH giants. This layered diversity in mined assets echoes a maturation of the crypto economy at large—one that values both robustness and culture.

Mining farms in Australia are also experimenting with hybrid models, combining mining machine sales with hosting and even maintenance services, offering comprehensive packages that appeal to novice and seasoned miners. This integrated approach is propelling industry growth, enabling newcomers to gain exposure without steep technical learning curves while providing scalability options for veterans ready to expand. Coupled with innovations such as AI-assisted machine optimization and predictive maintenance algorithms, Australian mining firms are setting new standards for operational efficiency.

In essence, as we look toward 2025, Australia stands poised to become not only a global hub for crypto mining investment but also a laboratory for next-generation blockchain infrastructure. Its unique combination of technological ambition, resource availability, and forward-thinking regulation is unleashing a powerful wave of innovation. Miners and investors tapping into this trend are not simply chasing short-term profits—they are shaping the future of decentralized finance through intelligent asset management, cutting-edge hardware deployment, and environmentally conscious hosting solutions.

To sum up, the next big leap in Australia’s crypto mining saga is not merely about amplifying hash rates or stacking more machines; it’s about reimagining the entire ecosystem. From the assembly lines of ASIC miners powering the Bitcoin network to sprawling mining farms capitalizing on green energy, Australia 2025 is on track to unravel a new chapter filled with unprecedented opportunities and challenges alike. As Bitcoin, Ethereum, Dogecoin, and emerging altcoins forge their futures amid this dynamic landscape, the synergy between mining machines, hosting infrastructure, and crypto exchanges will define who leads the charge in the dawning era of digital finance.

This article delves into Australia’s burgeoning crypto mining landscape, exploring the factors driving substantial investments. It highlights regulatory shifts, technological advancements, and environmental considerations, offering a nuanced perspective on the potential economic impact. The piece encourages readers to consider both the opportunities and challenges that lie ahead for Australia’s financial ecosystem by 2025.